From neobanks to traditional firms, we help fintech and financial brands launch personalized outreach campaigns, B2B or B2C, powered by AI, automation, and human SDRs.

.png?width=1310&height=651&name=CREDIBLY-Photoroom%20(1).png)

.png?width=1310&height=651&name=CREDDITED-Photoroom%20(2).png)

The primary reason for inconsistent growth is the lack of steady conversions at the upper funnel, specifically in turning leads into qualified meetings.

Discover how our solutions can generate qualified meetings with enterprise and business accounts for your organization.

Learn the perfect bridge to convert your investment from marketing into real meetings for your sales team

Grow your partnerships to establish a steady stream of referrals and new business opportunities.

Company type: SMB's, SaaS/subscription businesses, marketplaces, logistics, wholesale, healthcare, professional services, multi-entity companies, etc..

Size & complexity: 50–2,000 employees, multi-currency, multi-entity, growing invoice or payment volumes.

Stack signals: NetSuite / SAP / QuickBooks, AP/AR tools (Bill, Coupa), Stripe/Adyen, ERPs in migration.

Triggers we watch: new funding, cross-border expansion, rising chargebacks, long DSO, audit pressure, ERP change

Economic buyers: CEO/Business Owner, CFO, VP Finance, Head of Payments/Treasury

Finance ops: Controller, AP/AR leaders, Shared Services

Risk & compliance: Compliance/AML, Fraud/Risk Ops

Tech: CIO/CTO, RevOps/Finance Systems, ERP owners

C-Level: clear payback, lower fees, faster cash (DSO↓)

Controller / AP/AR: fewer manual steps, faster close, fewer errors

Treasury: liquidity visibility, FX/fee control

Risk / Compliance: audit-ready, fewer false positives

Tech: clean integrations, security, low lift for the team

.png?width=1100&height=619&name=infografico%20para%20pagina%20industrial%20de%20latinx%20(1).png)

Instant engagement: Every phone inquiry is answered live, ensuring no lead goes cold.

Fast follow‑up: All form submissions receive a response within 30 minutes or less.

Full visibility: Easily track conversion rates, lead quality, and performance across your marketing and sales teams.

Marketing and sales teams often find themselves at odds when performance falls short.

Marketing generates a steady flow of leads, but when the closing rate is low, the blame game begins:

What if you had a specialized department, enhanced with AI, that handles every lead from marketing, reaching out at the right time, following up consistently, handling objections, delivering real value propositions, and qualifying prospects before setting an appointment for the sales team?

That’s exactly what Latinx Revops provides:

✅ A seamless connection between marketing and sales.

✅ AI-driven lead qualification & human engagement.

✅ Sales-ready meetings with high-intent buyers.

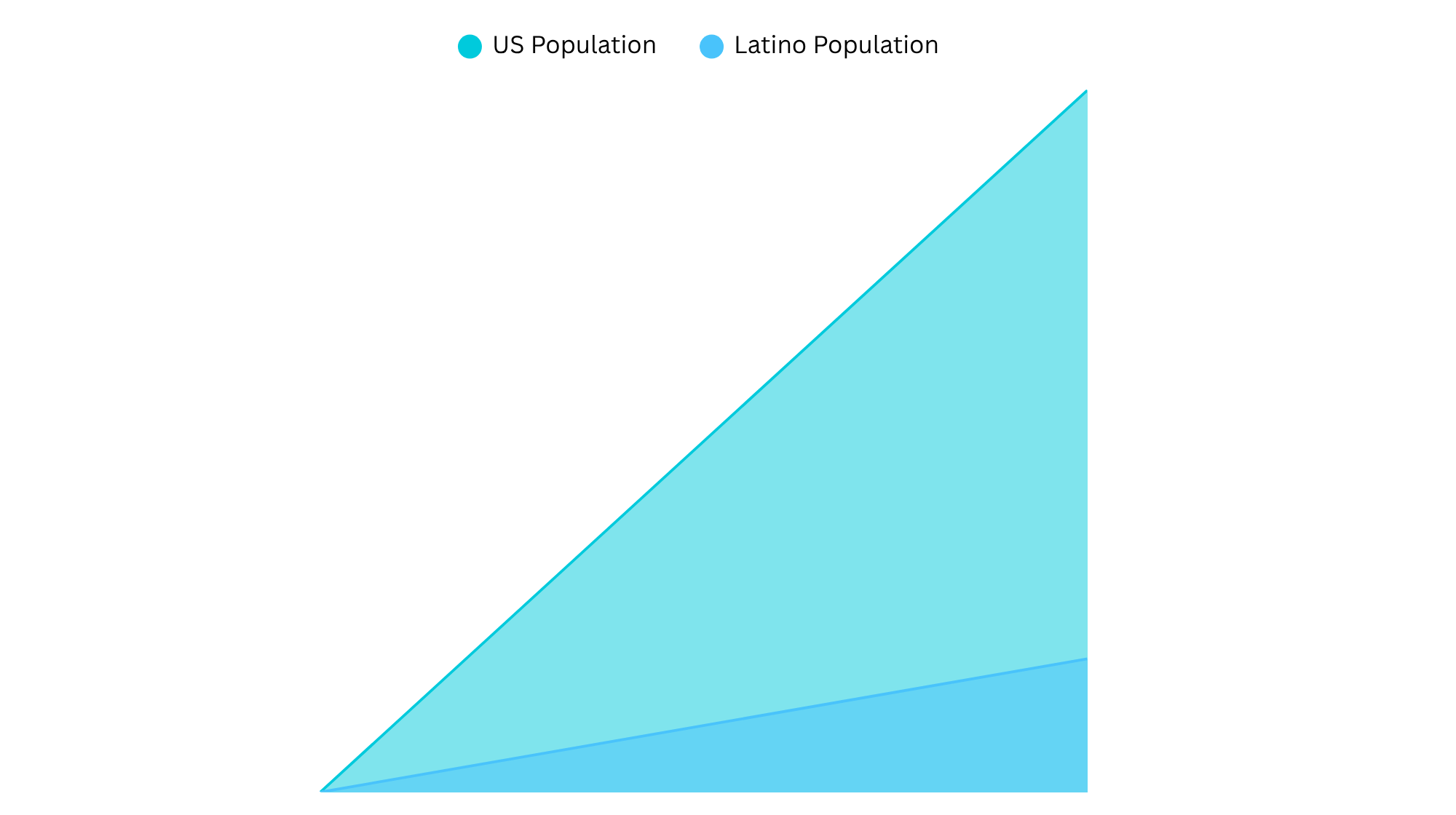

Why not expand to the spanish speaking market?

Our fully bilingual team can help you tap into the Latino industry

| Consider this: 19% of the US population is Hispanic. That's a massive consumer base of over 62 million people. And the opportunity is in more than just consumers. There are 3.3 million Latino small and medium business owners in America. Furthermore, the market is highly concentrated: 62% of Latinos in the US are Mexicans, totaling 38.5 million. Partner with our fully bilingual team and start growing your business today |

.png?width=2000&height=1120&name=Untitled%20design%20(7).png)

.png?width=1600&height=896&name=%F0%9F%93%8A%20Chartgraph%20%20(1).png)

.png?width=1600&height=896&name=%F0%9F%93%8A%20Chartgraph%20%20(2).png)

Every business needs new revenue streams. Partner with a specialized team that understands your complex sales cycle and helps you set in-person or video appointments with your ideal customers.